1. Introduction to Salesforce

Salesforce is a leading Customer Relationship Management (CRM) platform that offers a comprehensive suite of tools and services to help businesses manage their customer relationships and operations effectively. In the fintech industry, where managing customer data, streamlining transactional processes, and ensuring regulatory compliance are critical, Salesforce provides robust solutions to enhance operations, elevate customer service, and drive growth. This article explores how Salesforce’s Sales Cloud and Service Cloud can be leveraged to manage a fintech product effectively, emphasizing the importance of a robust Quality Assurance (QA) strategy.

2. QA Strategy for Salesforce Sales Cloud in Fintech

2.1 Functional Testing

Functional testing in Salesforce Sales Cloud is crucial to ensure that all features and functionalities perform as intended. Key areas include:

- Lead Conversion Process: Testing ensures that leads are correctly converted to opportunities through web or email channels, with associated accounts and contacts created accurately. For instance, using Salesforce’s web-to-lead and email-to-lead features, the QA team must align test data with the website and email. Issues in this area could lead to data discrepancies in related objects, such as Contacts and Accounts.

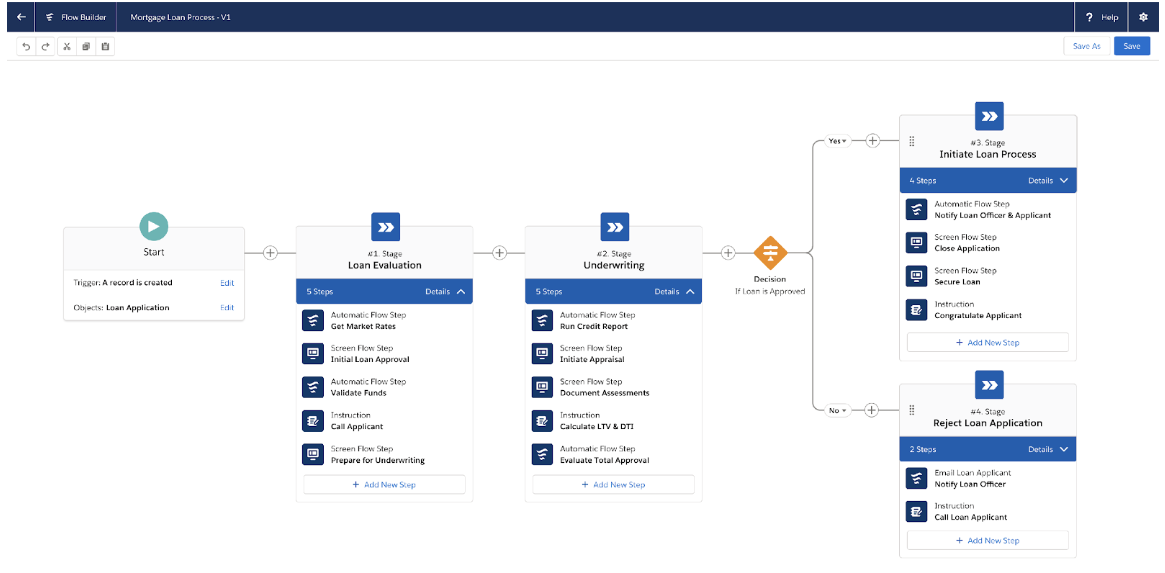

- Custom Objects (e.g., Loan Applications): Validation of custom objects like Loan Applications is essential to ensure that Salesforce workflow and validation rules trigger correctly. QA teams should focus on field-level testing, validating investments and deductions accurately. Errors here could affect related objects like Opportunities and Risk Profiles, leading to significant issues in subsequent data processing.

2.2 UI Testing

UI testing in Salesforce Sales Cloud ensures that the user interface is intuitive, visually consistent, and user-friendly. Key examples include:

-

Page Layout of Opportunity Records: QA teams verify that fields are correctly placed and accessible. A missing field or incorrect placement could negatively impact user experience, leading to errors during record interactions.

-

Record Views of Custom Objects (e.g., Loan Applications): Ensuring that necessary fields are visible and editable according to user profile permissions is critical. Discrepancies in this area could hinder data entry and visibility, potentially leading to incomplete or incorrect records.

2.3 Integration Testing

Integration testing is paramount in a fintech application, where Salesforce often integrates with various third-party services. Key examples include:

- Integration with Credit Scoring Systems: Ensuring seamless data flow between Salesforce and third-party credit scoring systems is crucial. Any delays or interruptions could result in credit score changes not being reflected immediately, affecting decision-making processes.

- Data Sync with External Databases: Verifying that data synchronization between Salesforce and external databases, such as those used for loan processing, is accurate and consistent. Issues in this area could lead to discrepancies in loan approval statuses, affecting objects like Loan Applications and Opportunities.

3. QA Strategy for Salesforce Service Cloud in Fintech

3.1 Functional Testing

In Salesforce Service Cloud, functional testing focuses on validating customer support processes, including case creation, omnichannel communication, service configurations, and AI-driven support. Key areas include:

- Case Management Process: Testing the creation, assignment, and resolution of cases ensures that all processes are functioning correctly. Issues in this area could affect related objects like Accounts and Contacts, especially if case ownership and status updates are not accurately reflected.

- Einstein Bots Automation: Ensuring that AI-driven responses are accurate and relevant is crucial. Bugs in this area could significantly impact user experience, leading to incorrect or incomplete customer support interactions.

3.2 UI Testing

UI testing in Service Cloud focuses on ensuring a seamless user experience in self-service portals and agent dashboards. Key examples include:

- Self-Service Portals: Testing the layout and functionality of knowledge articles and the case submission process is essential. UI issues such as misaligned buttons or missing fields could prevent customers from accessing necessary information or submitting service requests.

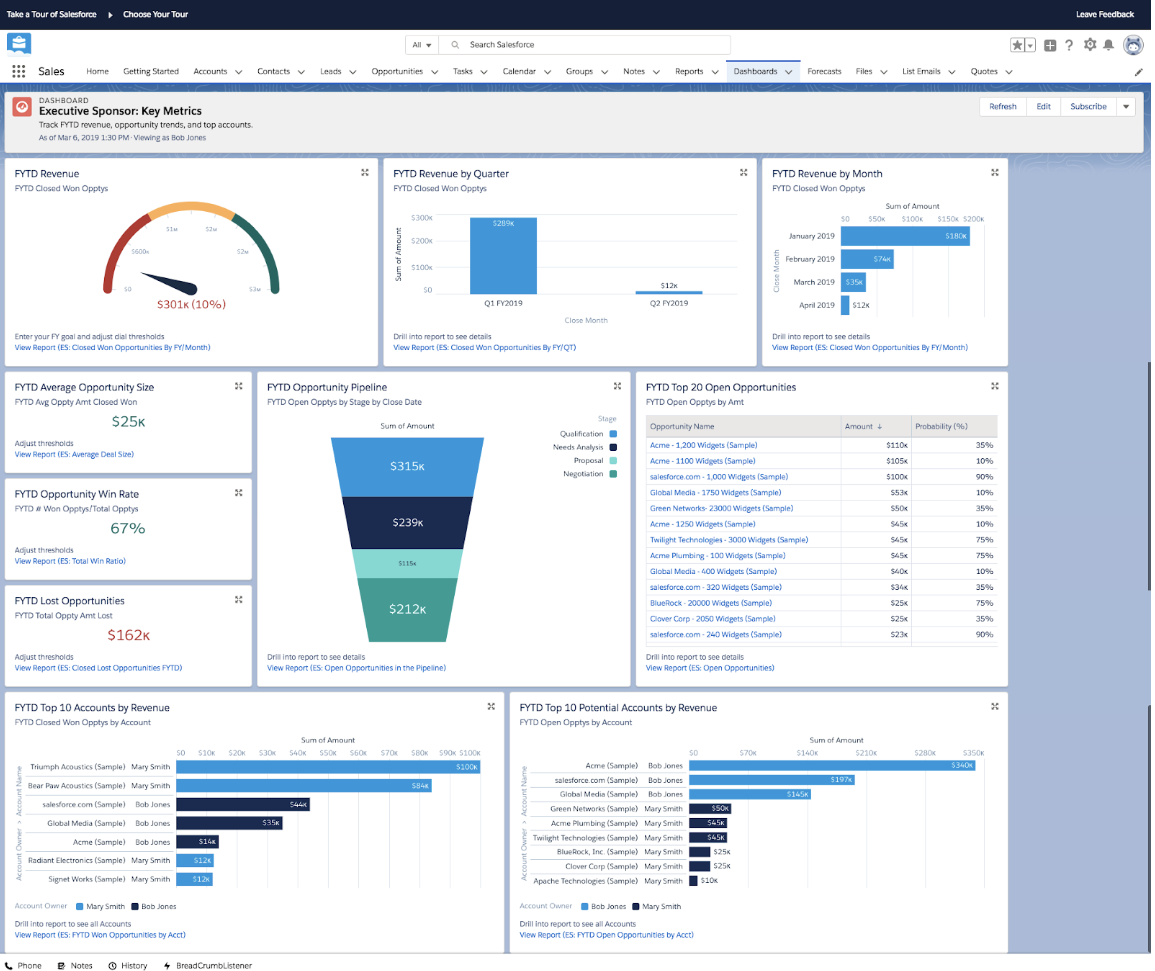

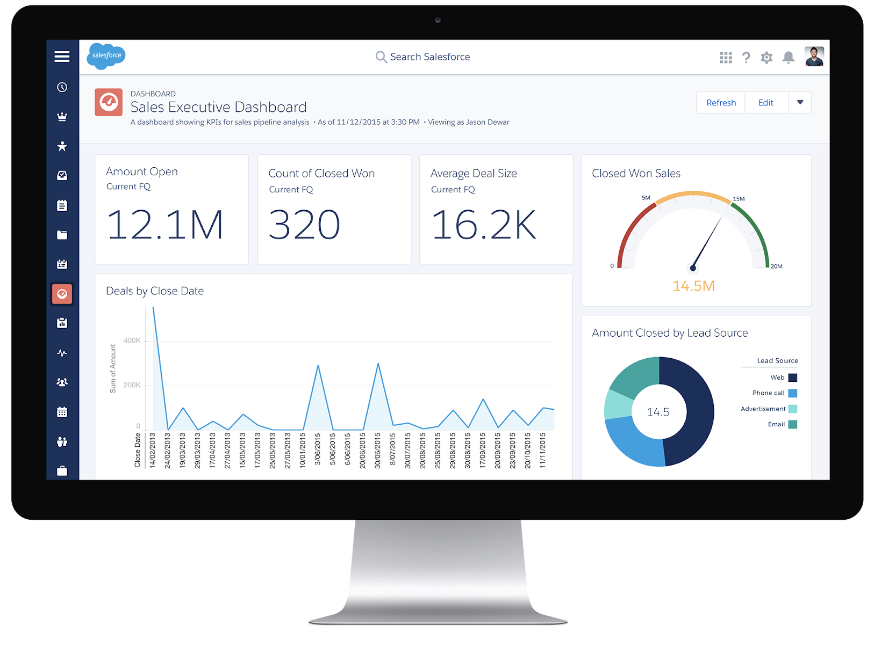

- Service Dashboards: Ensuring that support agents can efficiently manage their workloads is vital. UI issues here could lead to delays in case resolution, negatively impacting overall customer satisfaction.

3.3 Integration Testing

Integration testing in Service Cloud ensures that data syncs correctly between Salesforce and external customer support tools. Key examples include:

- Ticketing System Integration: Verifying that case data is accurately transferred between Salesforce and integrated ticketing systems ensures that updates in one platform are reflected in the other, maintaining consistency across systems.

- Impact on Objects: Integration issues could lead to discrepancies in case statuses or missing customer interactions, affecting customer support records and potentially impacting related objects like Accounts and Contacts.

4. Database Integration Testing in a Salesforce Fintech Application

4.1 Functional Testing of DB Integrations

Database integration testing ensures that Salesforce correctly integrates with external databases, which is crucial for data integrity. Key examples include:

- Customer Data Synchronization: Testing the synchronization of customer data between Salesforce and a centralized customer database ensures that updates, such as changes to Contact or Account records, are accurately reflected in the external database.

- Impact on Objects: Issues here could lead to data mismatches, affecting customer records and related objects like Opportunities, ultimately causing errors in reporting and analytics.

4.2 Security Testing

Security testing is critical to protect sensitive data and ensure compliance with industry regulations. Key examples include:

- Data Encryption: Testing data encryption processes ensures that sensitive information, such as customer financial data, is encrypted both at rest and in transit

- Role-Based Access Controls: Ensuring that only authorized users can access specific data fields is essential. Security issues in this area could lead to unauthorized access or data breaches, compromising the integrity of the Salesforce environment

-

Conclusion

Quality Assurance (QA) testing is indispensable for ensuring the robustness and reliability of a Salesforce-based fintech application. By thoroughly testing functional aspects, UI elements, integrations, and database connections, QA teams can identify and address issues that could affect user experience, data integrity, and overall system performance. As fintech applications continue to evolve, adhering to best practices in QA will remain essential for delivering high-quality solutions that meet industry standards and exceed user expectations.